What Homebuyers Need to Know About Flood Zones in the Conroe Area

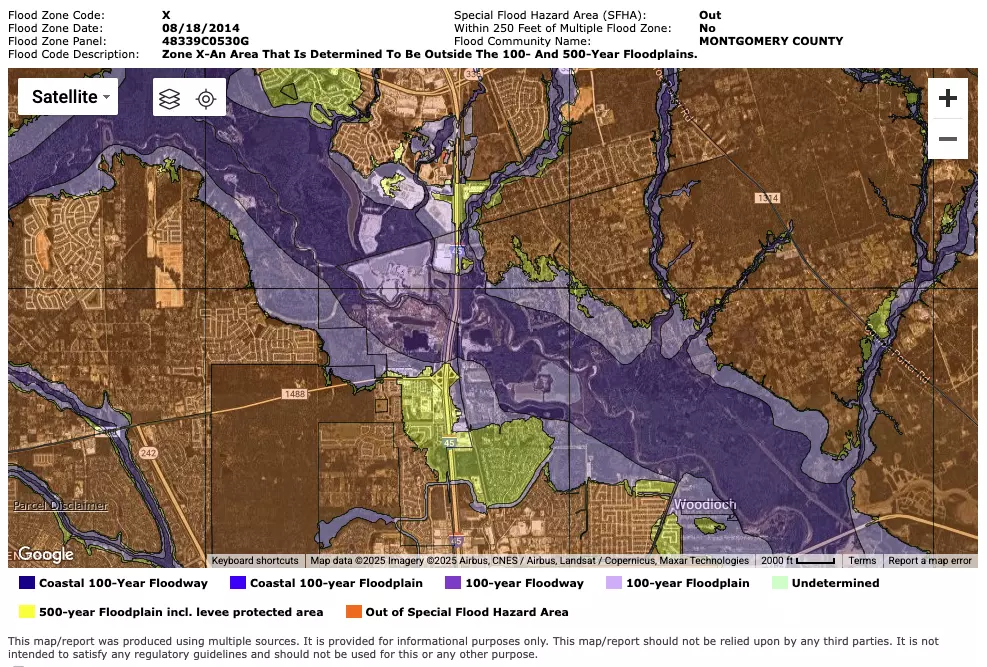

When buying or selling a home in Conroe, The Woodlands, or the surrounding areas, understanding flood zones is essential. Flood risk can impact home insurance costs, property values, and even mortgage approval. Whether you’re searching for a home near Lake Conroe or in a growing community like Montgomery or Magnolia, knowing a property’s flood zone can help you make an informed real estate decision.

What Are Flood Zones?

Flood zones are designated by the Federal Emergency Management Agency (FEMA) to indicate the likelihood of flooding in a particular area. These classifications help homeowners, buyers, and lenders assess potential risks.

Common Flood Zones in Our Area

In the Conroe and North Houston region, the most common flood zones include:

- Zone X (Low Risk) – Properties in this zone have a minimal risk of flooding. Flood insurance is typically optional.

- Zone X500 (Moderate Risk) – These areas have a slightly higher flood risk but are still considered outside high-risk floodplains. Flood insurance may be recommended but is not required.

- Zone AE (High Risk) – Homes in this zone have a 1% annual chance of flooding (also called a 100-year flood zone). If purchasing with a federally backed mortgage, flood insurance is required.

How Flood Zones Impact Real Estate in Conroe and Surrounding Areas

1. Home Insurance Costs

Flood zones directly affect the cost of flood insurance. Homes in high-risk areas (like Zone AE) require mandatory flood insurance, which adds to homeownership costs. Even if a home is in a lower-risk area, some buyers choose flood insurance for added peace of mind.

2. Property Values

Flood risk can influence property values. Homes in higher-risk zones may have lower values due to insurance costs and potential flood mitigation requirements.

3. Mortgage and Loan Considerations

Lenders assess flood risk before approving mortgages. In high-risk zones, additional insurance and documentation may be required. Buyers should review FEMA flood maps before purchasing a home to understand any additional costs.

4. Resale Potential

While homes in low-risk zones often have a broader pool of buyers, homes in high-risk zones can still be desirable if they have proper flood mitigation measures in place. Sellers should be prepared to provide flood insurance information to potential buyers.

5. Building and Renovation Restrictions

Some areas have building codes designed to reduce flood damage. If you’re planning renovations, check local regulations for requirements like elevation modifications or flood-resistant materials.

How to Check a Property’s Flood Zone

Before purchasing a home, check flood zone information through:

- FEMA’s Flood Map Service Center (msc.fema.gov)

- County Appraisal District Websites

- Local Real Estate Experts

Tips for Buyers and Sellers

For Buyers:

✔ Research Flood Insurance Costs – Even if it’s not required, knowing the costs helps with budgeting.

✔ Check Flood History – Ask sellers about past water-related issues.

✔ Review Elevation Certificates – These can provide insight into flood risk and potential insurance savings.

For Sellers:

✔ Disclose Flood Zone Status – Transparency helps buyers feel confident.

✔ Highlight Flood Mitigation Features – Features like elevated foundations or drainage improvements can be selling points.

✔ Price Competitively – Consider market factors when listing a home in a flood zone.

Final Thoughts

Flood zone information is an important factor in real estate decisions. Whether buying or selling, understanding how flood zones impact insurance, property values, and mortgages can help you navigate the market with confidence.

Need Expert Advice?

If you’re buying or selling a home in Conroe, The Woodlands, or nearby areas, I can help you assess flood risks and make informed real estate decisions. Contact me today!

Categories

Recent Posts